At Christmas dinner, this week, I ran into a common conversation.

Career shifts.

Every 30 year old at the table explained they wanted to move out of their current field.

They expressed concerns about AI’s impact in their job, but this wasn’t a surprise for me.

They all laid out plans to “do their own thing”.

Essentially, they wanted to move away from being an employee to a contractor.

There are pros and cons to being a contractor.

You won’t get the same benefits and it’s easier to be let go BUT there are some benefits.

Did you know independent contractors get paid up to 70% more than employees in the same position?

I’ve been on my own for the past 5 years, and I’m happy I did.

It’s opening more doors and opportunities I wouldn’t see.

TRENDING

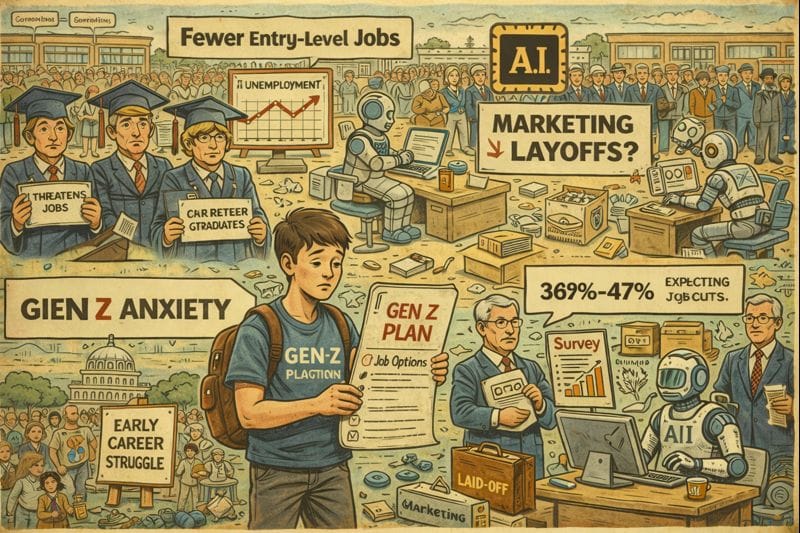

Graduate Job Market Weakens As AI Displaces Entry Work

AI technologies are replacing tasks once assigned to new graduates, leading to fewer early-career job postings and lower starting salaries.

Unemployment among recent college graduates in the United States has risen above the broader workforce rate.

Employers are increasingly assigning routine coding, data work and administrative duties to AI systems.

Universities are already expanding alternatives such as apprenticeships and hands-on training as traditional degrees lose their previous advantage.

Read more here.

The Update:

If you’re just entering the job market, be aware the old entry-level gateway is evolving.

Employers are looking for a mix of practical skills, AI implementation, and strong human skills.

Above ALL, human relationships are the key to unlock the opportunities.

This Christmas, I took an hour out of my day and send out dozens of “Merry Christmas” texts. It may not sound like much, but you never know which relationship will open the right door.

PROMPT AWARENESS

Want to know if you are quietly automating yourself out of a job?

Open ChatGPT now and use this prompt

Write this: “Below are my SOPs, templates, checklists, and handoff notes. Review them line by line. Flag anything that could be executed by an AI with little context. For each flagged item, tell me one concrete change I can make to introduce judgment, decision ownership, or client-specific thinking that keeps this work human.”

CMOs Expect Layoffs Tied to AI Cost-Savings Pressure

A new survey of chief marketing officers finds that 36–47% of marketing leaders expect workforce cuts over the next 12 to 24 months as companies seek to justify expensive AI investments by reducing headcount.

At larger firms, nearly half of CMOs said job cuts are likely, and many have already trimmed creative and support roles this year.

Expensive AI tools raise expectations for cost results, and teams are under pressure to show tangible savings through organizational changes.

Read more here.

The Update:

Marketers are among the first to feel this, but not the last.

Even as tools help with campaign execution and targeting, leadership is pushing for measurable returns.

This leaves fewer people doing routine, non human facing work.

(PS: We do see many companies that lay off people for AI are actually rehiring. Salesforce is a perfect example of this.)

It takes an average of 5 touches to close a deal.

Companies report up to 70% more leads with a tool like Apollo.

“Gen Z AI Anxiety” Reshapes Career Planning

A recent report found that 43% of Gen Z workers have changed their career plans because of anxiety about AI determining job prospects.

Many are pursuing skills they believe will be more secure, with a significant portion exploring trade work or AI-resilient professions that are considered harder to automate.

Younger workers increasingly use social media platforms such as TikTok and Instagram to find internships and career advice.

The Update:

Career choices are being influenced less by traditional norms and more by what appears safe from automation.

Stay relevant. Be prepared.

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Quick Hits

Interviewing Via AI Avatars Enters Real Job Searches

Some companies are experimenting with AI avatars to conduct early rounds of job interviews, raising questions about how personal interaction and assessment will change in hiring processes.Salesforce Scales Back Some AI Use After Layoffs

Following a large round of workforce reductions, Salesforce executives acknowledged trust issues with certain AI models and scaled back deployment in some divisions, demonstrating that not all AI rollouts produce the expected benefits.AI Has Been Linked to Tens of Thousands of Layoffs in 2025

Analysis shows that AI has been cited as a factor in over 50,000 planned layoffs in 2025 alone, particularly in entry-level and administrative functions, as companies restructure around automation.

“History rhymes”

Mark Savant

Forward this email to 1 person.

Relationships matter guys. A simple phone call, a forwarded email, a picture text.